Don’t Mess with Texas

The COVID-19 pandemic of 2020 will enter our chapter of history as a defining moment. It is the black swan event of a lifetime that has challenged our national resolve and policies. Despite some of the catastrophic outcomes the pandemic has laid upon us: over 300,000 deaths globally, over 38 million unemployed in the United States, and a shadow of uncertainty cast upon the world – there is hope. And just north of the Rio Grande, that hope shines bright. Through a combination of powerful demographic trends, succinct state policies, and a dash of luck, the Lone Star State looks ahead to a future of growth and prosperity; the Texas Miracle is poised for yet another astounding run. Here we’ll explore the effects of COVID-19 on Texas, those effects relative to other population centers within the U.S., and why the economic momentum of Texas will continue to thrust the state ahead of its peers.

Subscribe now for more CONTI insights

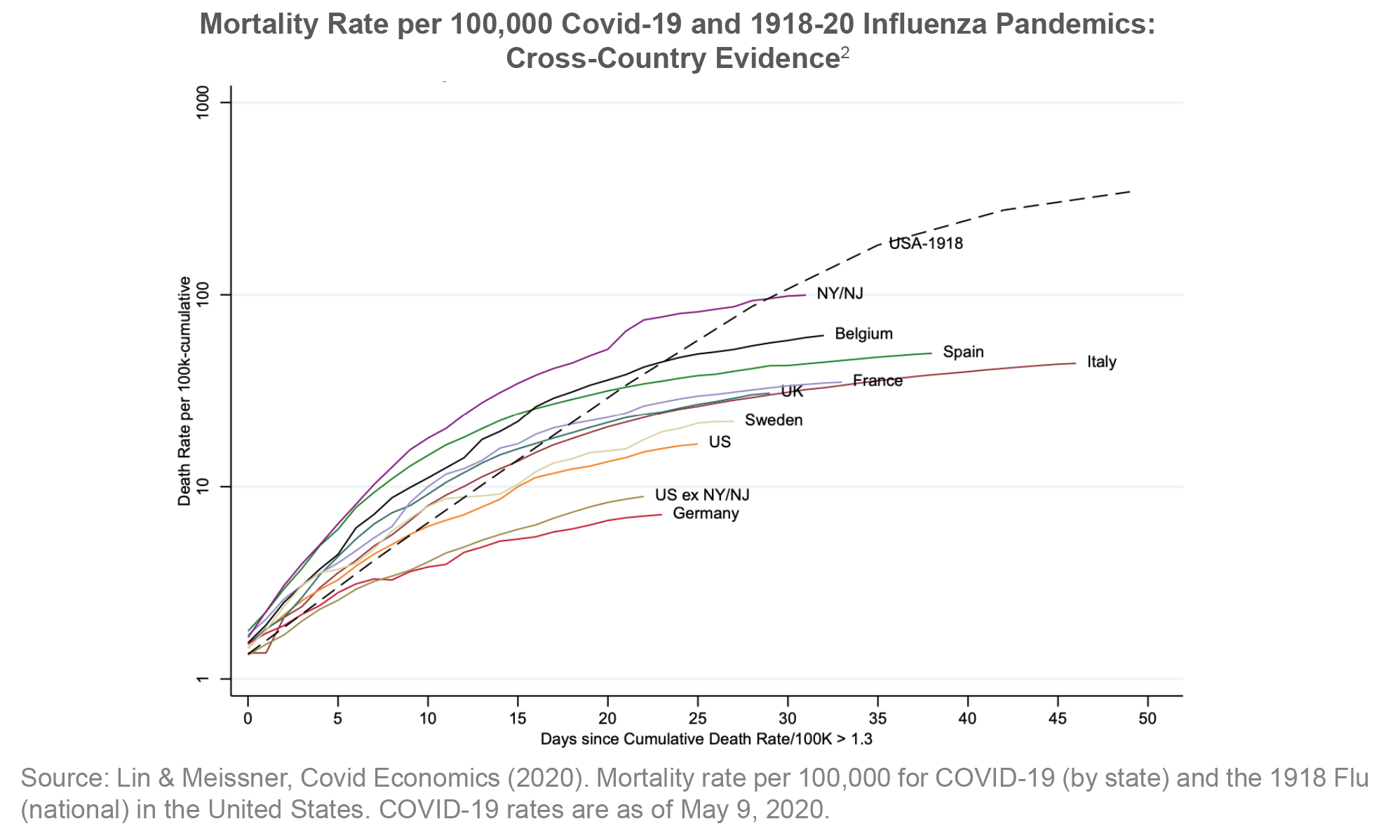

The effects of the COVID-19 crisis within the United States vary widely across measures of health and the economy. In a case of good fortune, the negative impacts in Texas are relatively restrained on both fronts. Despite having the second-largest population of any state, Texas ranks as the 11th lowest state in per capita active COVID-19 cases. As of May 20, Texas’ 1.77 per capita caseload is well below other densely populated states like California, 2.18 cases per capita, while remaining wildly lower than some of the nation’s hot spots like Massachusetts, 13 cases per capita, and New York’s startling 18 cases per capita[1]. As policymakers across the nation weigh key decisions on social distancing measures, these case metrics, along with hospital capacity indicators prove vitally informative.

In terms of hospital capacity, Texas remains only slightly elevated above normal trends. Over the past week, hospital bed utilization in the city of Dallas averaged 64 percent and ventilator utilization has yet to tick above 39 percent since April 1st[3]. The figures are considerably lower than New York City today, where hospital bed utilization comes in at roughly 73 percent after peaking at over 80 percent in early April[4].

While we cannot discount the severity of the COVID-19 crisis, we must recognize the goal of policymakers is to safely reopen businesses and prevent further economic distress. Flattening the curve does not mean closing off the economy until a vaccination is in sight, it means carefully evaluating regional measures of caseload and healthcare capacity to keep the virus at bay while emboldening business to keep running. While some state leaders have struggled to define their policy goals, a structured vision has been definitive from day one in Texas. Texas was one of the first states to begin reopening efforts while maintaining social distancing measures; it’s likely to be one of the first to feel the economic benefits as well.

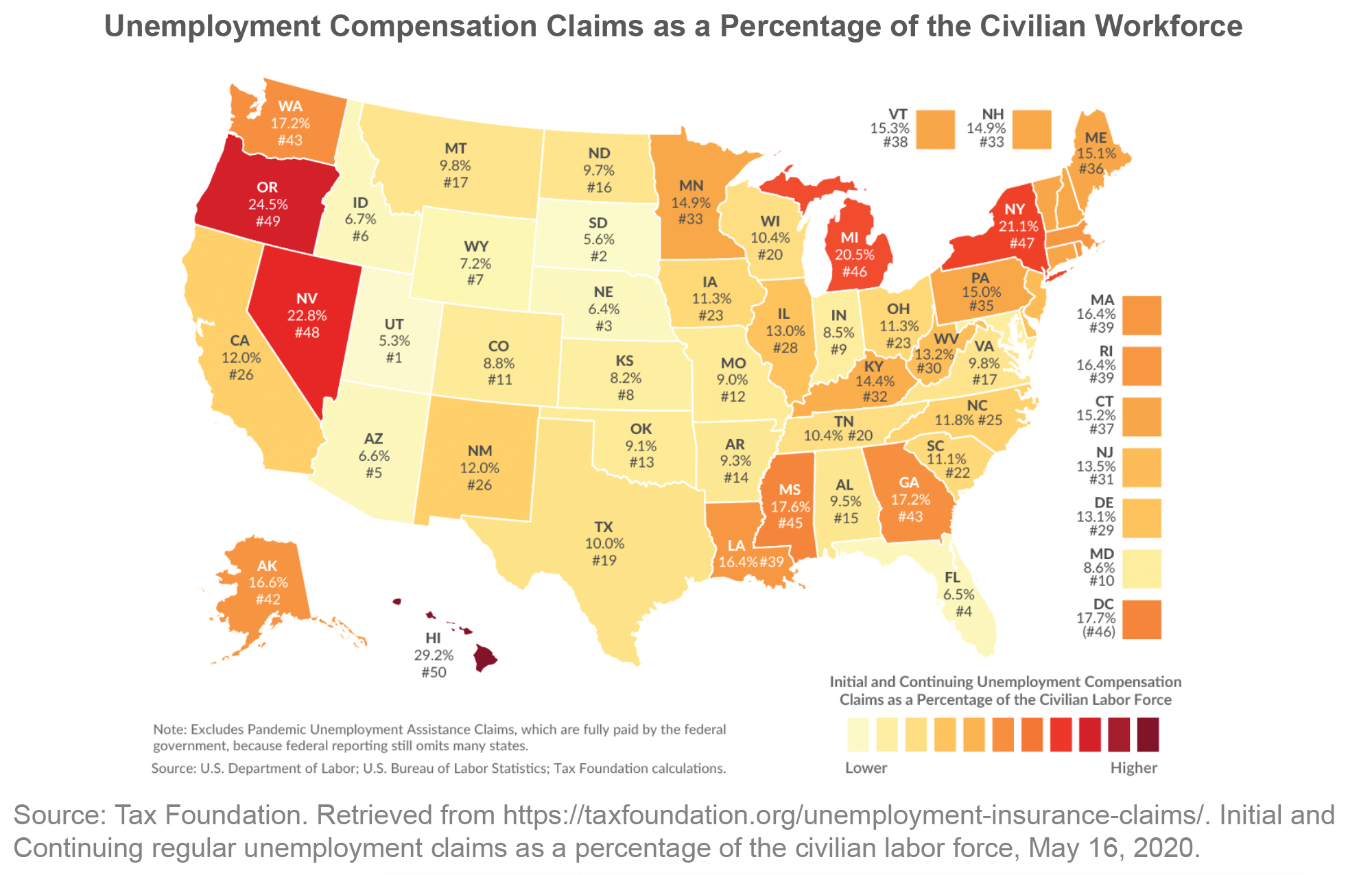

Armed with the rare combination of clear policy from state leadership and the good fortune of a relatively low caseload, the negative economic impacts in Texas are negligible relative to its industrious contemporaries within the U.S. of May 15, Texas had the sixth-lowest rate of per capita initial unemployment claims since the start of the pandemic[5]. At 67 claims per capita, the Texan total is nearly half of the per capita distress in urban centers like Massachusetts (119) and Washington D.C. (123). Across the U.S., initial unemployment claims continually decreased over the past 6 weeks; the worst economic damage is likely behind us [Now is the Time to Invest in Multifamily – Texas is the Place]. Additionally, the economic damage in Texas was dampened by the federal government’s blanket relief policies.

The colossal $3 trillion coronavirus federal relief package enacted in March was designed to aid Americans through easily executed means and without respect to regional variations in economic conditions. Although the $1,200 direct relief to nearly all American taxpayers and the added $600 monthly federal unemployment benefit may seem plentiful to Texans, the story is vastly different for workers on the nation’s coastline. Coastal cities like New York, Boston, and San Francisco have a highly constrained housing supply and as result, a high cost of living. Aside from housing costs, the price of a representative basket of consumer goods doesn’t vary all too much around the U.S. Consequently, workers in low housing cost markets, like Texas, unduly benefit from blanket relief.

Take another comparison between Dallas and New York City. In Dallas, the median household income is roughly $50,000 and the average rent per unit falls just above $1,200 according to apartment data provider RealPage. In New York, the median household income is roughly $60,000, but the average rent per unit exceeds $3,500 – nearly triple the average cost in Dallas. While a monthly $600 federal benefit may keep unemployed Texans afloat, it’s nothing more than a drop in the bucket for distraught New Yorkers. Unsurprisingly, a large share of New Yorkers are unable to pay rent. According to a landlord survey conducted by the Community Housing Improvement Program, roughly a quarter of New York tenants skipped their rent in May[6]. The driver of this national disparity, housing affordability, was experiencing a political moment in 2019. In the years to come, housing affordability will continue to define the nation’s demographic shifts and domestic political affairs. Elected officials where housing costs constrict workers will face mounting pressure as the COVID-19 crisis magnifies the issue. Subsequently, the demographic trends of the past decade within the U.S. are likely to accelerate.

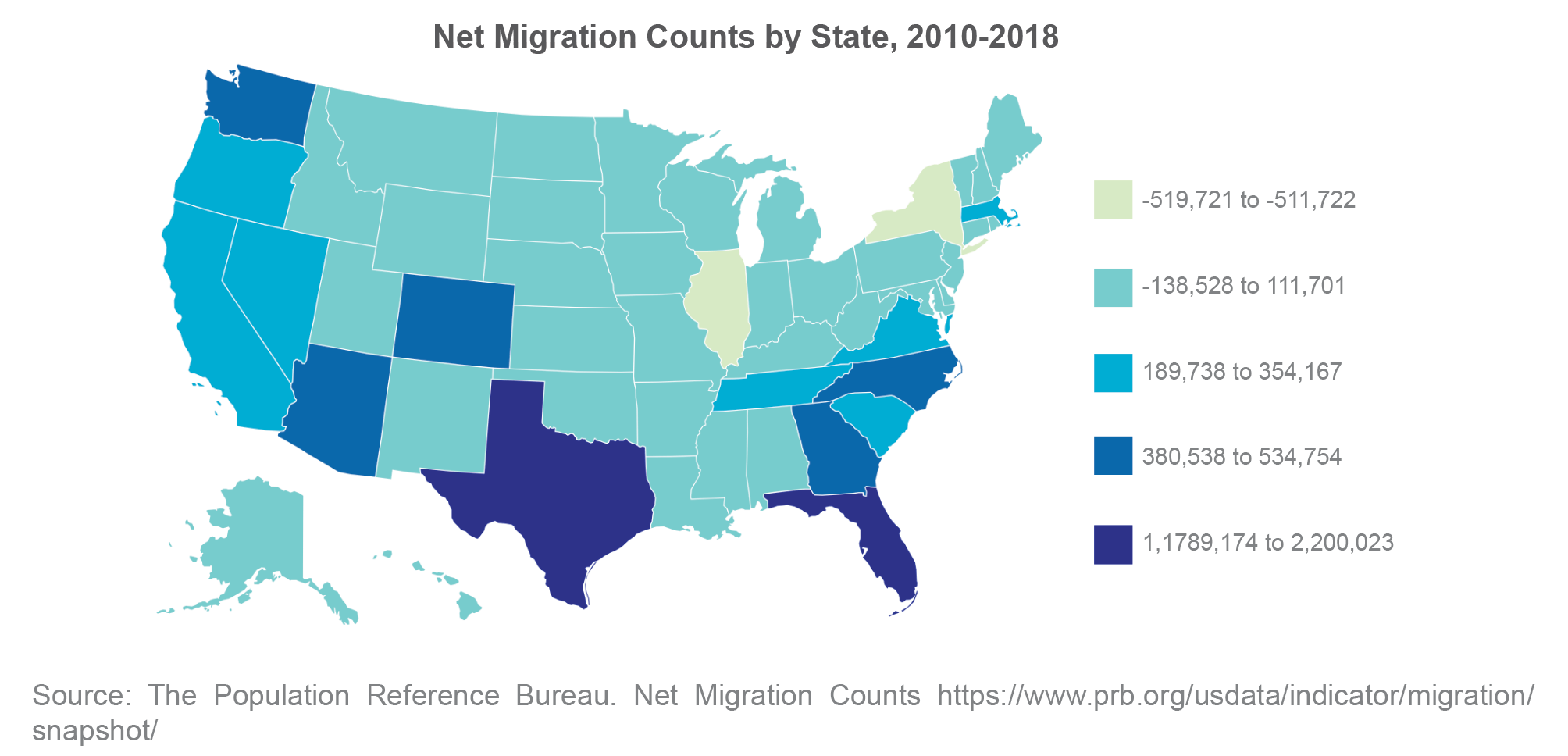

Americans are moving from the high-cost coasts and the withering Midwest to business-friendly and affordable southern states, where Texas is an undeniable leader. From 2010 to 2018, Texas had the second highest net migration of any state, accounting for over 1.7 million people and roughly 24 percent of the nation’s entire migration influx. The factors that drove this unbelievable migration remain in sure footing entering the new decade. The state’s very identity is forged by low taxes, attainable housing, warm weather, and clear political leadership. Today, such an environment is difficult to rival as is the strength of Texas. Once again, Texas is ready to prevail and lead, serving as a beacon and an added tailwind to our recovery as a nation.

SOURCES

1 The COVID Tracking Project. (2020). Retrieved from: https://covidtracking.com/

2 Lin & Meissner. Covid Economics. (2020). A note on long-run persistence of public health outcomes in pandemics. The Centre for Economic Policy Research. Retrieved from: https://cepr.org/sites/default/files/news/CovidEconomics15.pdf

3 City of Dallas. (2020). City Hospital Capacity. Retrieved from: https://public.tableau.com/profile/cityofdallasdtxinnovationteam/vizhome/City

ofDallasCOVID-19Dashboard/Dashboard1#!/vizhome/Book3_15862351183220/DFWRegionalCases

4 The Office of the Governor. (2020). Retrieved from: https://coronavirus.health.ny.gov/home

5 U.S. Department of Labor. (2020). Unemployment Insurance Weekly Claims Data. Retrieved from: https://oui.doleta.gov/unemploy/claims.asp

6 Georgia Kromrei. (2020). About 25% of NYC renters didn’t pay in May: survey. The Real Deal: NY Real Estate News. Retrieved from: https://therealdeal.com/2020/05/19/about-25-of-nyc-renters-didnt-pay-in-may-survey

Additional Sources:

Dallas Fed’s Social Distancing Index shows greater social distancing measures are highly correlated with economic indicators.

https://www.dallasfed.org/research/economics/2020/0521