The Demographics Behind Multifamily’s Stable Demand Growth

Like any investment, multifamily real estate returns are primarily a function of projected future income growth. The shifting balance of supply and demand largely drives projected future income for multifamily real estate. However, unlike many investments, overall demand for multifamily is well-defined as a basic human need, well-measured by consistent and timely reporting of demographic and geographic information, and anticipated by the dependable movement of people and jobs. While individual multifamily investments are undoubtedly subject to local market dynamics, a broad perspective of multifamily demand helps illustrate one of the core tenets of CONTI’s multifamily strategy: invest in regions where population and jobs are poised to grow. At the root of this growth is the largest generational cohort of Americans, the generation of future renters, “Generation Z.”

Subscribe now for more CONTI insights

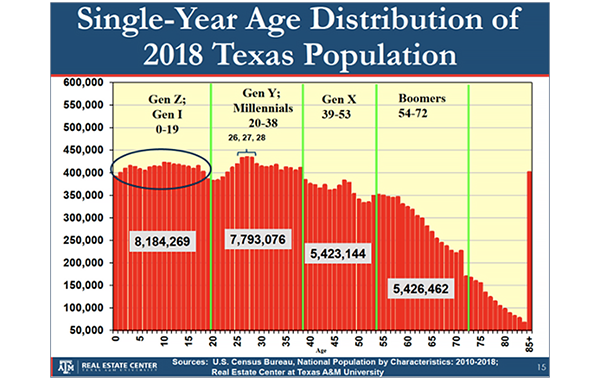

Generation Z, or the group of Americans born after 1996, can trace its magnitude to the U.S. Baby Boom from 1946 to 1964, following the return of American soldiers from World War II. At over 72 million people, the “Boomer” generation was the largest cohort of Americans until the arrival of their grandchildren, Generation Z. Fueled by the massive population of Generation Z, the demand for U.S. housing will only continue its steady and rapid expansion throughout the next decades. This growth in sheer demand is also accompanied by Gen Z’s increased educational attainment, shifting housing preferences, tightening household budgets, and delaying life events that consequently delay homebuying. With these critical changes, Generation Z will not only be the largest cohort of renters the U.S. has ever seen but also the cohort most likely to rent longer than any before it.

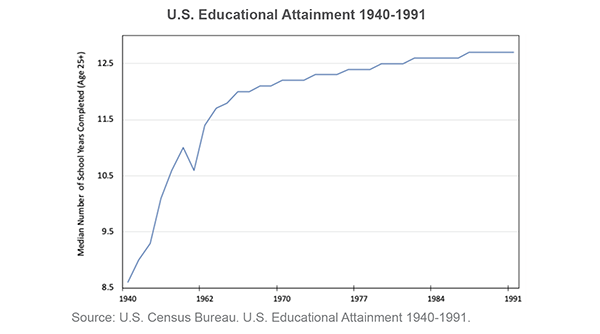

Since the 1940s, educational attainment for the average American has increased by roughly 50 percent, to nearly 13 years of schooling. While this may seem trivial to multifamily demand, it is candidly, a paradigm shift. The effects of increased educational attainment on multifamily demand lie broadly in the relationship between university students and the American model of university housing. Unlike many nations, where university students often commute from a parent’s home, the higher education model in the U.S. encourages students to relocate for their studies. In the U.S., there is a cultural expectation for those taking the “traditional” college path to move out of their family’s home for university attendance.

Due to this unique cultural phenomenon, American universities often provide an abundance of apartment-style housing options. For example, approximately 50 percent of the student population lives on campus at Dallas-Fort Worth’s Texas Christian University. In addition to university-provided housing, the niche private student rental market surrounding universities houses an estimated 5.16 million students across the nation. Regardless of living “on” or “off” of campus, most American students experience what it’s like to live away from family and among their peers in an apartment community while attending university. This experience, coupled with the cultural expectation of relocation for university studies, reduces university students’ psychological costs of future movement. As more students pour into American universities, the pool of prospective renters grows, and future multifamily demand strengthens. For multifamily investors, this relationship bodes well; according to the Pew Research Center, Generation Z is more likely to be enrolled in college than any previous U.S. generation.

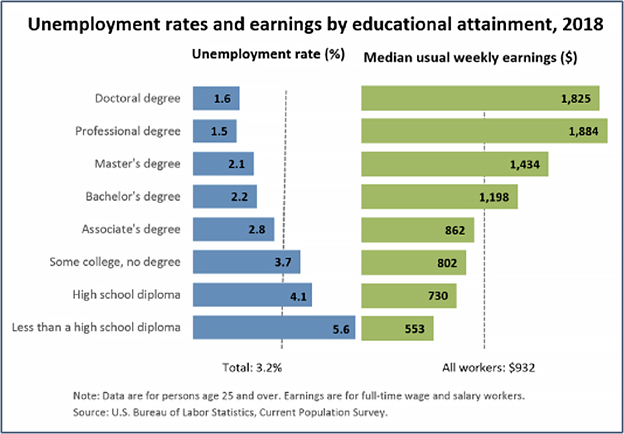

Aside from reducing the mental costs of relocation and renting, greater educational attainment also results in other more distinct benefits to future multifamily demand. Americans with greater educational attainment are more likely to be employed and earn higher wages. Moreover, as Americans increasingly attend college, costs are following suit; from 1990 to 2020, average prices tripled at public four-year institutions after adjusting for inflation. This steep rise in the cost of higher education results in an expected debt of at least $50,000 for Generation Z university students. While gaining stable employment and wages, graduating students are delaying home purchases relative to previous generations due to this rising debt burden. Debt is assuredly a contributing factor to the delay of home purchases, but broader demographic trends associated with educational attainment are also driving this delay for young Americans.

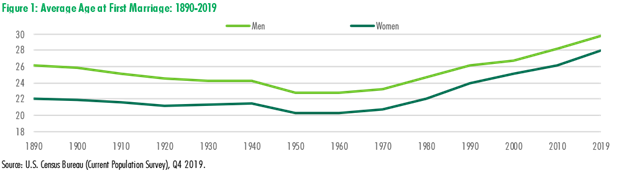

With greater educational attainment comes a delay in significant life events, such as marriage and child-rearing. The monumental shift in women’s careers across the U.S. magnifies these demographic trends. Over the past 70 years, the integration of women into American universities and correspondingly higher-paying jobs proved immensely prosperous for the U.S. economy and multifamily demand. Women now represent approximately 57 percent of all U.S. university students and, once graduated, further contribute to the delay in marriage. From 1960 to 2019, the average age of first marriage in the U.S. rose seven years for both men and women. According to the National Association of Realtors, this delay directly increases multifamily demand, as married couples account for over 60% of homebuyers across all age categories. As American couples marry later and delay homebuying, the long-term demand for multifamily steadily grows.

At CONTI, we believe that the massive undercurrents of societal expectations and demographic trends influencing Generation Z provide the path to sound multifamily investments. We believe that this upcoming generation, the largest in American history, will also become the most educated, the highest-earning, most accustomed to renting, and the longest renting cohort of Americans to date. Unlike many investments, the multifamily market is not dependent on some speculative future demand, but on the unyielding tide of over 70 million Americans in Generation Z. While we cannot precisely predict the future, the patterns of the past, sustained over decades of American history, illustrate enduring multifamily demand for the decades to come.