New Apartment Construction Can’t Quash Demand for Rental Housing

Vacancy rates illustrate increasing demand for apartments, but in most markets, there just isn’t enough supply, despite a new wave of apartment construction in the pipeline, per a CONTI Capital analysis of newly released CoStar data for the first quarter of the year.

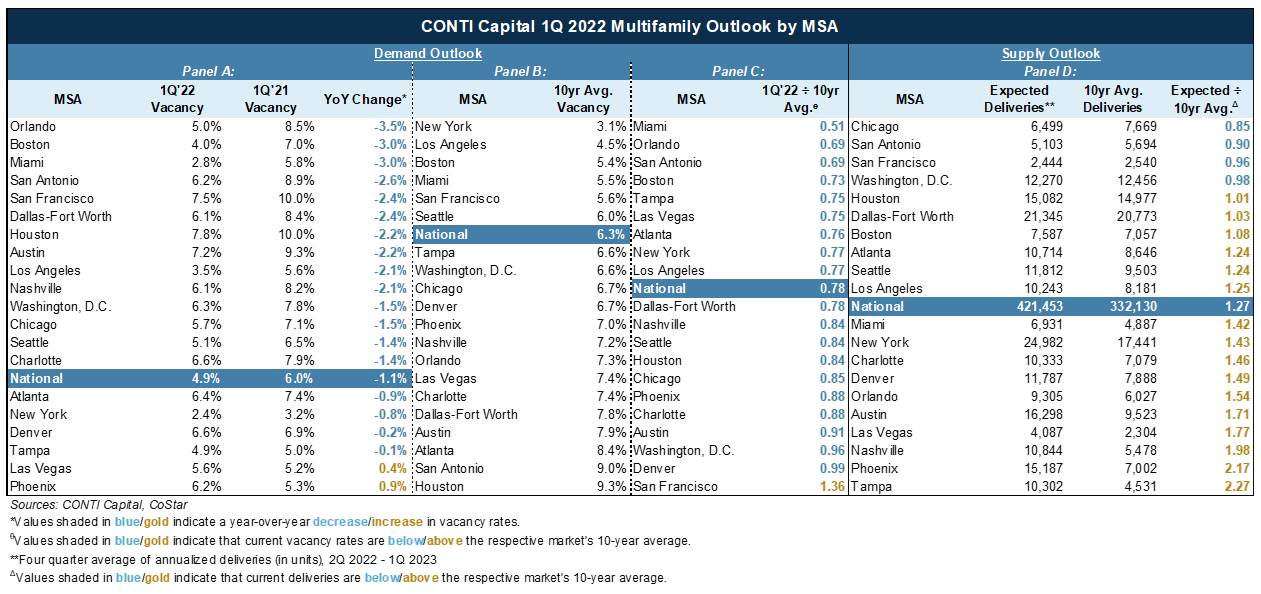

The chart below gives a breakdown of the vacancy rates and supply outlooks for the U.S. and several metropolitan statistical areas – some Gateway markets and some Sun Belt markets.

Subscribe now for more CONTI insights

Vacancy rates in the first quarter of 2022 were mostly lower than vacancy rates in the first quarter of 2021, as we can see in Panel A, reflecting increasing demand for units. Nationally, the average multifamily vacancy rate was 4.9% at the end of the quarter, down from 6.0% a year earlier – a 1.1 percentage point drop within an already tight supply. The Sun Belt market of Orlando surpassed all metros with a huge 3.5% drop in vacancy rate.

All but one of the top 20 markets we track experienced a lower vacancy rate in 1Q2022 compared to each market’s own 10-year average, as shown in Panels B and C.

Meanwhile on the supply end, a good chunk of these markets are seeing a significant uptick in construction of new apartment units from the current quarter into the first quarter of 2023, as we see in Panel D. Developers are attempting to rise to meet the growing housing need – but as we’ve covered before, they are encountering delays.

Nationally, an average of 332,130 apartment units were delivered per year over the past 10 years. Over the next four quarters, however, we expect to see 421,453 units delivered. This projected new supply is 27% above the 10-year average.

Chicago, San Antonio, San Francisco and Washington, D.C. are the only markets expected to see a slowdown in the pace of new deliveries compared to recent history. San Antonio is particularly interesting because it is expected to see a supply slowdown despite the fact that the current vacancy rate in that market is well-below its 10-year average. This is one reason why San Antonio is one of our top markets for multifamily investments in 2022.

We expect to see two times the typical delivery volume in Phoenix and Tampa over the next year, but we aren’t concerned about oversupply in either market considering the below-average vacancy rates shown in Panel C above.

Based on this data and further breakdowns by our experts, CONTI believes that the multifamily market harbors strong fundamentals, and vacancy rates will remain low relative to historical norms despite a swell of expected construction deliveries. CONTI is focused on Class A, apartment properties within high-growth markets in the Sun Belt region, and based on the supply/demand outlook, income projections remain strong.