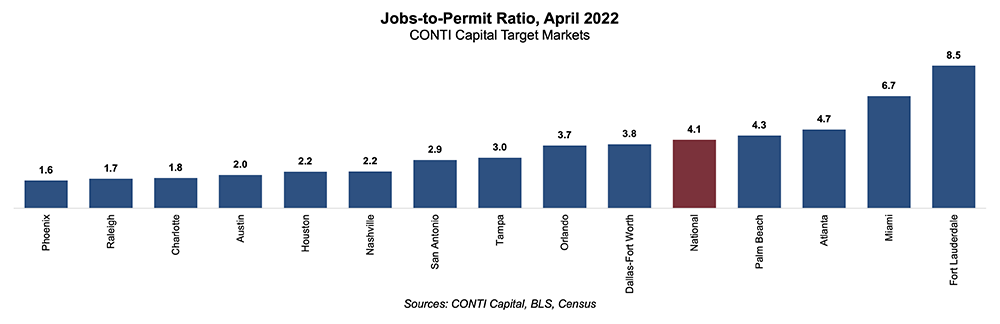

New Housing Supply Is Not Keeping Up with Job Openings in Major Markets

For every permit created for a single-family home or an apartment unit in a major metro, multiple more jobs are created, beckoning more in-migration and perpetuating the supply-demand imbalance for livable space, according to a CONTI analysis of data from the U.S. Bureau of Labor Statistics (BLS) and the United States Census Bureau.1,2

The ratio of job growth to residential building permits has increased in recent years — higher ratio values indicating a higher number of jobs than permits, which create more demand-side imbalance and a more landlord-friendly market.

Subscribe now for more CONTI insights

In Atlanta, for instance, for every permit created for a single-family home or apartment unit from April 2021 to April 2022, 4.7 jobs were created. Over the past two years, there were an average of 1.2 jobs per building permit pulled that year. Over three years, there was an average of a single job per residential building permit in the Atlanta metro.1,2

This higher ratio value is fueled by a tight labor market, causing the demand for labor to press upward on the demand for housing. This is true in all the major metropolitan areas that CONTI tracks. Among CONTI’s target markets Austin and Nashville, there are currently twice as many jobs created as residential permits that were filed in this year, and nearly that many in Charlotte. There are almost four jobs created per every residential permit pulled in the Dallas-Fort Worth metro, and there are three jobs for every housing unit to be constructed in the Tampa metro.1,2

The COVID-19 pandemic left a visible impact on the current permits-to-jobs ratio. Some metros like Chicago and Los Angeles are seeing much higher jobs ratios per permit this year, but it’s important to remember that those markets saw a later recovery from the financial blows of the pandemic than did Sun Belt markets in general, accounting for their bigger job numbers.1,2

Housing Supply Not Able to Quell Demand

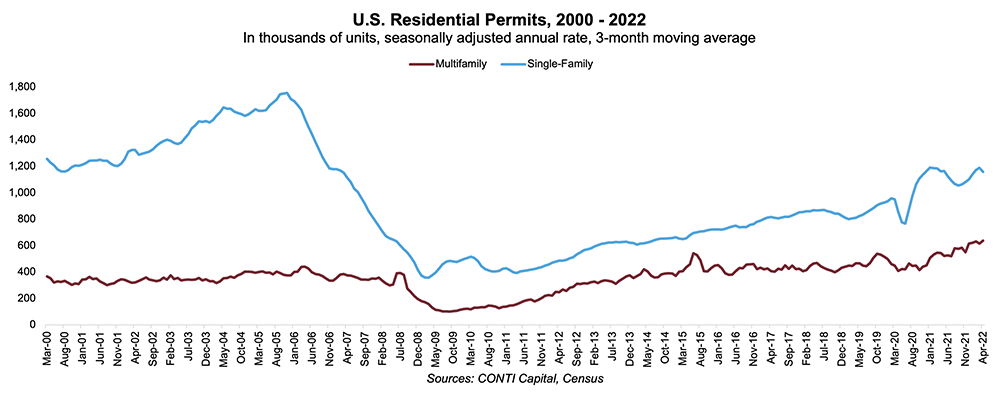

The Census recently released residential permit figures for April 2022, and while permit numbers were lower than expected, developers are still pulling more permits than they were a year ago. While a wave of new housing supply, both residential and multifamily, is expected in the near-term, it won’t be enough to meet housing demand.

Permits are forward-looking and tell us what is to come in a year or so in terms of supply.

The number of permits created for apartment units in properties consisting of 5 units or more increased by 16.3% year-over-year in April 2022.2 CONTI’s own analysis of Census and BLS data indicates permitting levels within the past year in the major metro areas we track are generally higher than historic averages.

However, our confidence in the demand for housing has not changed. Between the lack of affordability in the homebuying market, high mortgage rates, huge numbers of prime renters, and jobs driving migration to Sun Belt markets, we foresee much more apartment supply will be needed in the near-term to meet demand.

SOURCES

1 “TED: The Economics Daily.” U.S. Bureau of Labor Statistics, https://www.bls.gov/opub/ted/2022/payroll-employment-up-by-428000-in-april-2022-down-by-1-2-million-since-february-2020.htm. Accessed 21 September 2022.

2 “Building Permits Survey.” United States Census Bureau, https://www.census.gov/construction/bps/statemonthly.html. Accessed 21 September 2022.