Single-Family Home Price Growth Is Breaking Historical Averages

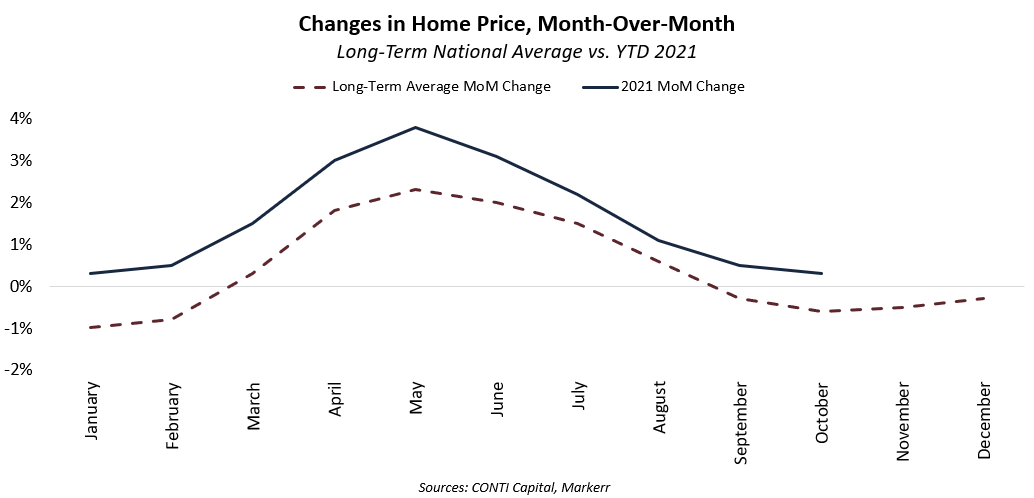

Recently, the median home price in the U.S. reached a historic high of $379,700. Single-family home prices have been climbing drastically and this increasing lack of affordability has only exacerbated the barriers to homeownership. For renters looking to transition into their first home, we do not expect 2022 to offer much relief. Though we’ve seen some softening in the rate of increase, the current price trajectory is well above historic averages and we forecast it to remain positive in the foreseeable future. The chart below compares the long-term average month-over-month (MoM) price increases to the MoM increases in 2021 (data available to date).

Subscribe now for more CONTI insights

Prices usually follow a seasonal pattern of going up in the spring and summer months and falling in autumn and winter. But in 2021, only price increases were reported. Price growth over the past spring and summer were especially robust – shooting past the long-term average by 40 to 150 bps.

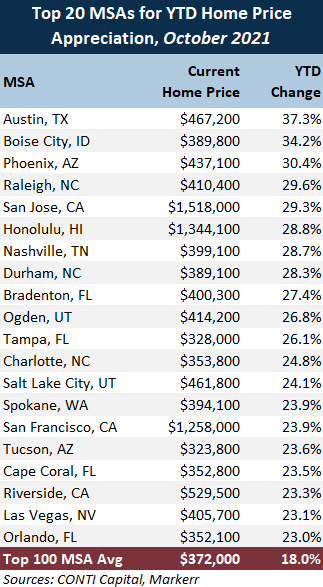

This pricing squeeze for would-be homeowners was significant in many markets. The most drastic 2021 home price growth was felt in Austin, where the median home price of $467,200 was up an incredible 37.3% between January and October. Other markets making the list for home price growth include Phoenix, Raleigh, Nashville, Durham, Tampa, Charlotte and Orlando. Incredibly, the top 100 metropolitan areas appreciated 18% on average.

What Does This Mean for Multifamily?

Historically high home prices have been an added benefit for the multifamily industry. Apartment unit supply has not been able to keep pace with demand in many markets for some time and the affordability crisis with single-family homes has kept would-be homeowners in rental properties.

This is a trend and we do not see it going away in the foreseeable future. We believe that unless there is sufficient intervention on the many crises affecting affordability, there will continue to be increasing numbers of households who will always see homeownership out of reach.